The rise and fall of the euro

January 13, 2012 -- Updated 1702 GMT (0102 HKT)

In a bid to resolve the crisis, a majority of European leaders in December reached a deal for a new intergovernmental treaty to deepen the integration of national budgets. Britain refused to back the agreement while three other countries -- Hungary, Sweden and the Czech Republic -- said they would consider the plan.London (CNN) -- Just one decade after the European single currency was launched amid fanfare and fireworks, its future continues to look uncertain as the debt crisis that engulfed Greece, Ireland and Portugal threatens the entire bloc -- and the wider global economy.

European leaders were optimistic that a proposed fiscal compact, designed to ensure that governments do not spend beyond their means and rack up unsustainable debts, could be signed by the end of January.

But while solid demand at recent debt auctions in Italy and Spain calmed some investors, a Reuters report Friday that said ratings agency S&P could downgrade several eurozone countries at some point sparked a fresh bout of worries.

Before the December summit, economists had feared that if European politicians failed to reach a consensus the eurozone crisis could trigger a global slump. Some went even further -- Alain Juppe, ex-French prime minister, told French media that the crisis "raises the specter of a return to violent conflict on our continent."

Many analysts saw it all coming of course, arguing that one fiscal system could never work for 17 EU countries that adopted the euro, serving more than 330 million people.

The flaws were exacerbated after some countries were suspected of fudging their numbers, including Greece which in 2004 admitted it gave misleading information to gain admission to the eurozone. The crisis exploded after Greece revised its figures to show its 2009 budget deficit would be 12.7% of gross domestic product -- far higher than the eurozone limit of 3%.

The bloc -- whose financial fractures may not have been apparent during the boom years -- then began to unravel.

After Greece's dire numbers were revealed, investors panicked and the country was unable to raise money to fund itself. The country was forced to take a €110 billion bailout from its eurozone peers and the International Monetary Fund.

But Greece's bailout, rather than stemming the panic, served as a harbinger to the debt crisis.

The European Financial Stability Facility, or European bailout fund -- set up to deal with further financial stumbles -- was quickly tapped again.

Ireland, felled by a black hole in its banking system, was forced to take a €67.5 billion bailout package in November 2010. After the markets then closed their doors to Portugal, it was also forced to take a €78 billion bailout.

The troubled nations implemented austerity measures to try to rein in their hefty piles of debt, but confidence in the bloc's ability to stabilize itself continued to fall.

The crisis may yet engulf Italy, which makes up 17% of the eurozone economy. Greece, Ireland and Portugal make up less than 6% between them.

And so Europe's politicians and officials have desperately tried to sort out the mess by coming up with ideas including boosting the bailout fund, bringing the disparate economies closer financially, and tapping other markets for funds.

Their previous measures proved ineffective, as the markets -- and the world -- remained unconvinced at the bloc's ability to survive in its existing form.

Germany and France, the largest economies in the bloc, led the call for EU countries to unite and find a joint solution. Now the majority of member states have come up with a new deal to be ready by March 2012.

The 17 members of the eurozone that share the single currency have agreed on an intergovernmental treaty to deepen the integration of national budgets, and six other EU nations support this plan. Another three have agreed to consider it. They have also agreed to hand over the running of the Europe's bailout funds to the European Central Bank and to add €200 billion to the International Monetary Fund.

Britain remains isolated by the deal that will now be tested by the markets.

The 10 biggest tech stories of 2011

from:www.cnn.com

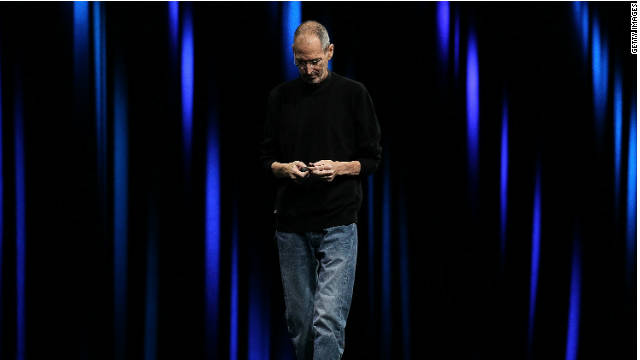

The world of entertainment mourned and remembered Steve Jobs with social media mentions.

(CNN) -- The technology industry often finds itself pontificating about the future, but the busy news cycle this year gave us plenty to discuss.

Very influential tech pioneers died; cyber-security cost companies billions of dollars; and trends in electronics and on the Web provided new tools and created new challenges.

Smartphones and tablets each grew so immensely this year that we decided to give them their own mobile year-in-review list.

As for future talk, there were plenty of bold, futuristic initiatives that did not quite bear fruit this year.

The seeds of Hewlett-Packard's mobile strategy, Google's plans for Motorola post-acquisition, Intel's 3-D silicon transistors and mobile payment systems like Google Wallet were planted this year. But those stories were left off of this list because their products did not reach a mass market in 2011. Look for those to make big splashes in 2012.

These 10 stories in 2011 had a huge impact that could resonate for many years:

1. Steve Jobs dies

From humble middle-class roots to running the most valuable tech company in the world, Apple co-founder Steve Jobs was powerful and revered. His death on October 5 after a long battle with cancer made waves around the world.

Public grieving could be seen outside Apple's hundreds of stores, where fans left flowers, candles and written notes of tribute. His authorized biography by Walter Isaacson, which came out in November, instantly became a bestseller.

At Apple, Jobs helped create the personal computer industry, and built a team that worked with him to design mega hits like the iMac, iPod, iPhone and iPad. He also found time to lead Pixar Animation Studios, the "Toy Story" creator that the Walt Disney Co. paid $7.4 billion to acquire in 2006.

The fast-paced tech industry halted for a moment after Jobs' death this year, prompting business and world leaders to speak publicly about his impact. It may never be the same after.

2. Social media's role as a tool for protestors

Much praise was heaped on Facebook, Twitter and YouTube after they played a role in the Arab Spring, a series of protests in the Middle East that started late in 2010.

Use of social networks to spread the word about demonstrations persisted this year, especially in the Egyptian uprising that toppled longtime President Hosni Mubarak.

In London, participants in riots used BlackBerry Messenger.

Micro reports from Occupy Wall Street and other U.S. protests frequently popped up on Twitter.

Perhaps in a nod to those events, Facebook CEO Mark Zuckerberg said onstage at his conference this year, "We exist at the intersection of technology and social issues."

3. Hackers

The Guy Fawkes mask, a stark white symbol of political upheaval, can be seen at many Occupy protests, but the accessory from the movie "V for Vendetta" was adopted earlier by an online group called Anonymous.

Members of the loosely organized group emerged from the Internet underground this year with a series of politically fueled computer attacks on churches, e-commerce and banks. A sister group called Lulz Security staged its own hacks before quickly vanishing.

After Sony's online networks had been hacked, researchers discovered a file planted on one of its servers containing the Anonymous chant, "We are legion." The word "hack" was so ingrained in people's vernacular after all of these incidents that it became a catchphrase anytime a site was down or an account password had been stolen.

4. Tablet market gets dozens of new entrants

The decade-old tablet PC market received a jolt with new products this year, sparked by the massive success of Apple's iPad.

Electronics makers tried to figure out whether consumers were looking for tablets or just iPads. Google, with its Android tablets, and Research in Motion, with the BlackBerry PlayBook, were not pleased with the answer.

Amazon.com may have cracked the formula with its $199 Kindle Fire. It has been selling about a million devices each week since it debuted in November. Hewlett-Packard only managed to attract meaningful sales to its TouchPad when it ran a $99 fire sale to clear inventory.

5. Facebook and partners add 'frictionless' sharing

What do you call it when someone you know finds out something about you without you telling them?

Facebook calls it "frictionless," and companies that have implemented the feature, including some music-streaming services and news publishers, have found a great promotional vehicle.

Still, many are opposed to their private reading habits being broadcast instantly to their Facebook pages. Zuckerberg is convinced people will continue publishing more about themselves online each year -- now, whether they actively choose to or not.

6. Patent wars

The biggest names in mobile, including Apple, Google, HTC, Microsoft, RIM and Samsung, have engaged in a giant game of patent Risk.

These companies have filed lawsuits and countersuits in countries around the world to seek licensing agreements or block the sale of rivals' products. Google has said that its $12.5 billion acquisition of Motorola Mobility was to gain the phone maker's stockpile of patents.

Check with your local government about whether you can legally buy a Galaxy Tab in stores this week.

7. Google+

People are spending more of their time on social networks than searching the Web. In other words, more Facebook and less Google.

So Google created its own Facebook-like environment in Google+. Users can share photos and browse friends' updates.

Google+ got off to a promising start, but Facebook has had a long lead. Google asserts that its social network is key to the future of the company. That's a big bet.

8. Apple becomes the most valuable company in the world

When Jobs returned to Apple in 1997, he said the company was weeks away from bankruptcy. Over the next decade, he orchestrated a masterful turnaround that culminated in Apple briefly becoming the world's most valuable company by market capitalization.

Exxon Mobil has reclaimed a sizable lead, but that shouldn't undermine how effective Apple has been in creating a lust for gizmos. The ultra-thin iPad 2 has done gangbusters, and the iPhone 4S, with Siri, has introduced voice-command services to a wider audience this year.

9. IBM's Watson beats human champs on 'Jeopardy!'

At times, the Watson computer, built by IBM, failed to understand some nuances of the English language, prompting mocking laughter.

However, as the world had learned when IBM's Deep Blue defeated chess champion Gary Kasparov, computers aren't clueless. Watson proved that two smart men, Ken Jennings and Brad Rutter, were no match for banks of servers running artificial-intelligence software.

10. Spotify and Facebook take on digital music

With iTunes and iPod, Apple had a strong formula for dominating the digital music industry. Amazon and Google haven't made a dent.

But Spotify has proved itself as a worthy opponent in Europe, and after years of negotiations with the record labels, it finally hit U.S. shores this year.

Facebook Music, a page that shows what friends are listening to, has helped introduce wider audiences to on-demand streaming services like Spotify, MOG, Rdio and Rhapsody.

No comments:

Post a Comment